Investment Platform For Fund of Funds and Multi-Asset Portfolios

Risk Shell is a comprehensive Software as a Service (SaaS) platform for alternative investments and multi-asset investment portfolios. It offers a complete solution covering the entire investment process including asset selection, portfolio construction and optimization, stress testing, peer group analysis, data management, CRM and due diligence tools. The Fund of Funds Manager, a part of Risk Shell, offers various tools for post-investment tasks, including fund shadow accounting, portfolio management, and reporting. Risk Shell is used by a diverse array of institutional investors, spanning from fund of funds managers to HNWI wealth managers and family offices. Our clients share a common need for sophisticated risk analytics and customized solutions, which are not typically offered by conventional risk platforms.

Risk Analytics, Portfolio Management & Portfolio Construction At Your Fingertips

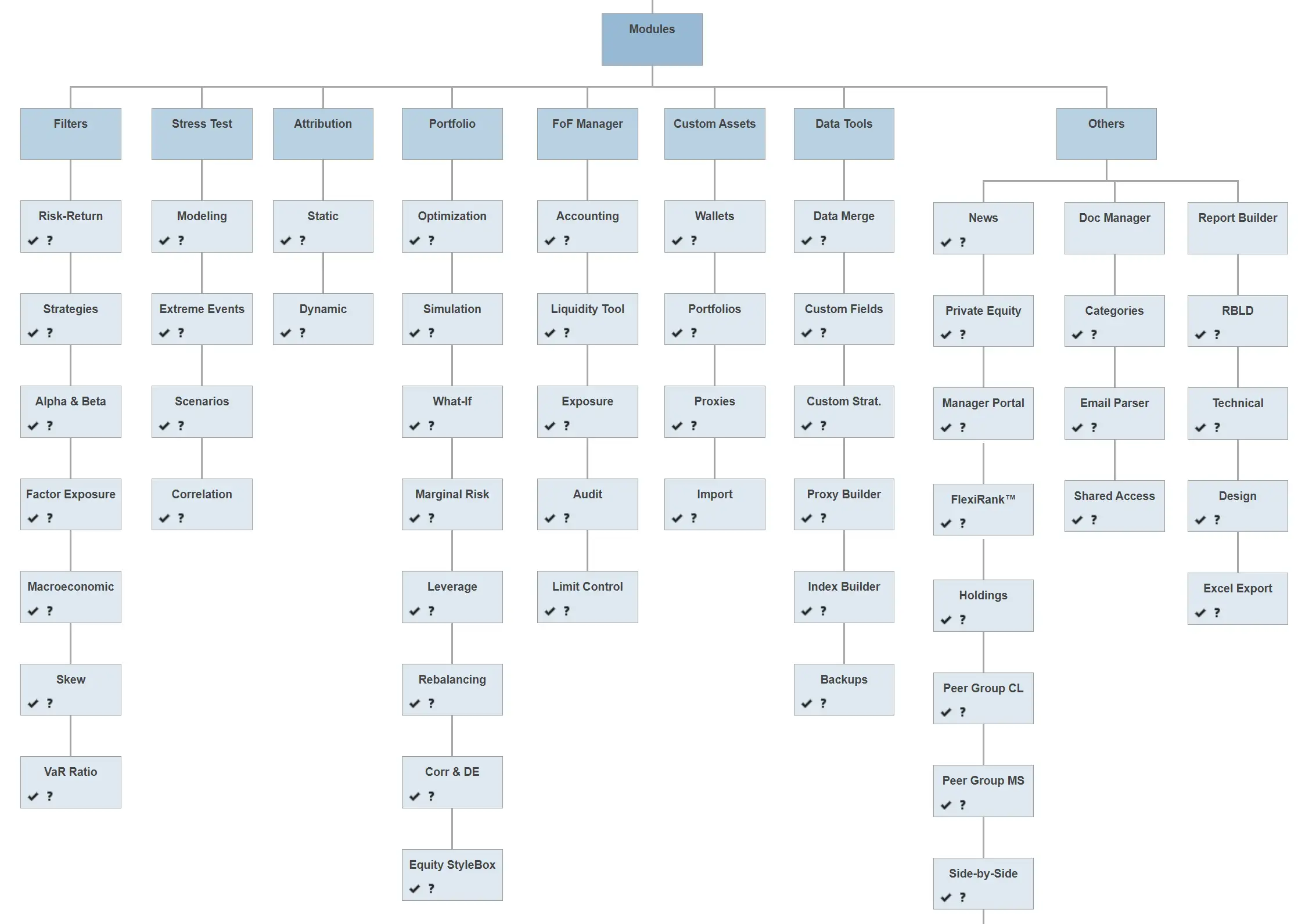

The Risk Shell analytical engine comprises the following functions:

- Quantitative and qualitative asset screening and manager selection

- Risk analytics delivering hundreds of statistics

- Macroeconomic Scenario Screening™

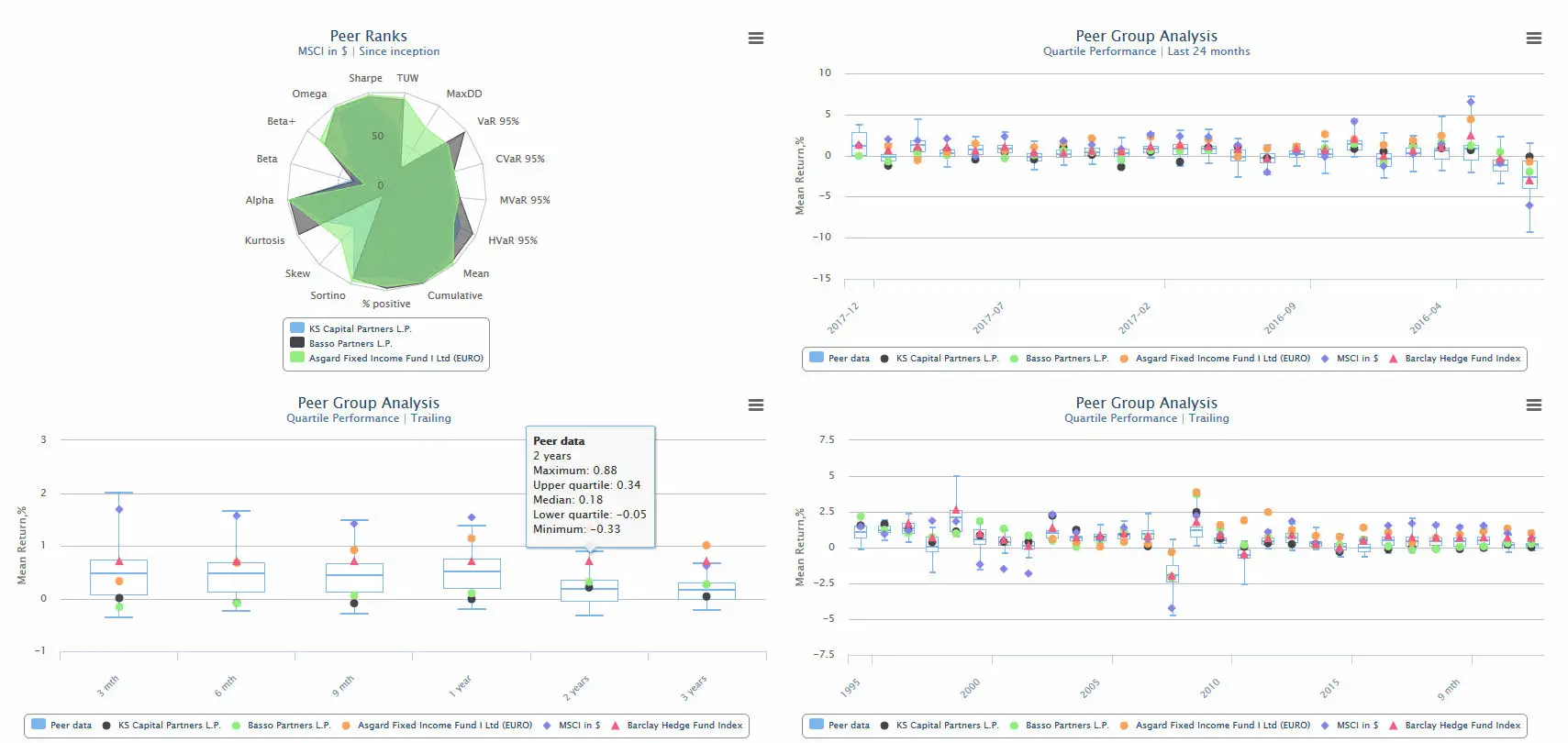

- Multi-statistic and traditional Peer Group Analysis

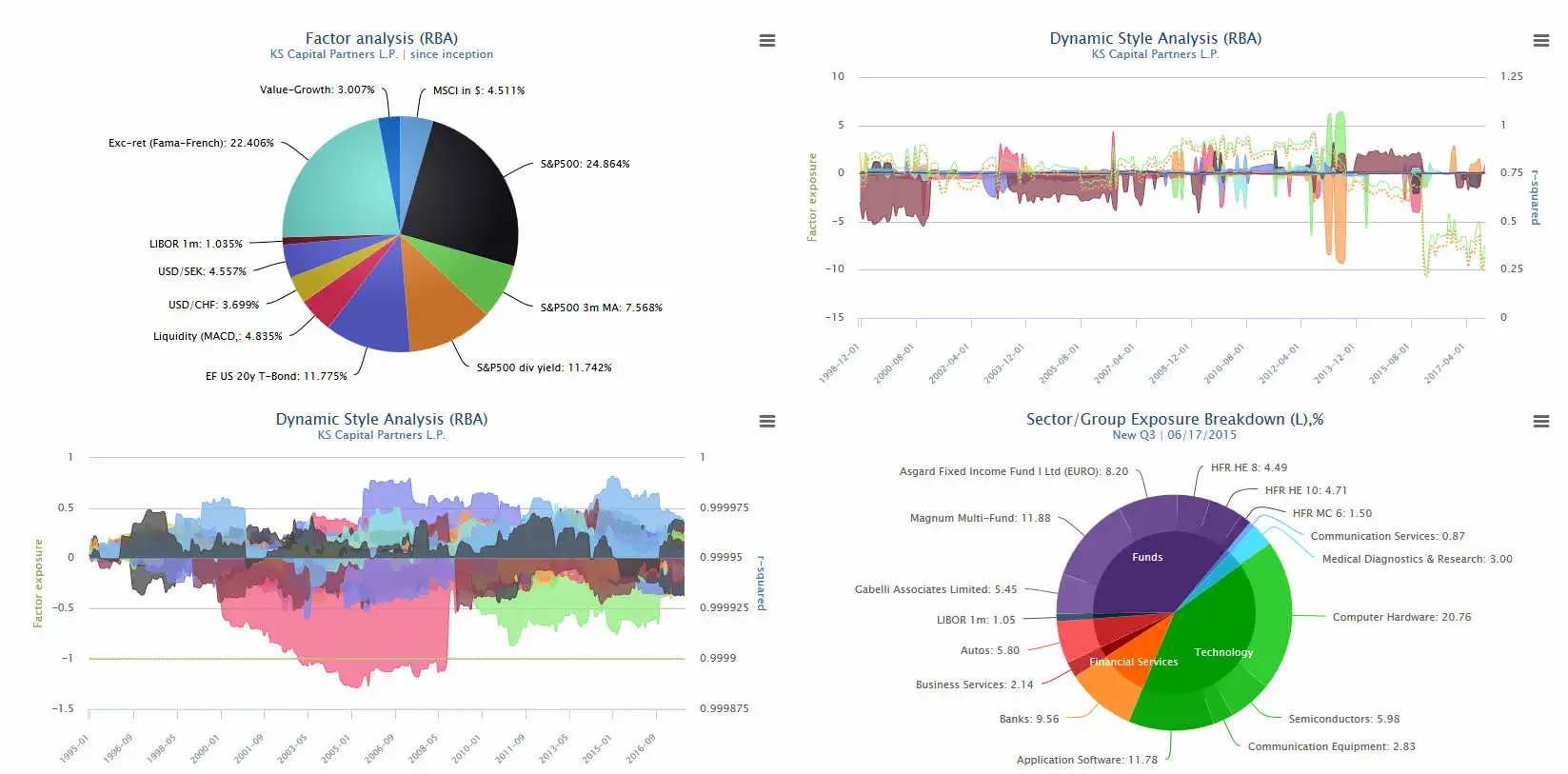

- Returns-Based Analysis and Holdings-Based Analysis

- Portfolio optimization with Market-neutral Portfolio Builder

- Optimization back testing

- Portfolio What-if analysis

- Portfolio marginal risk contribution

- FlexiRank™ component - a user-defined asset ranking system

- Portfolio stochastic simulation

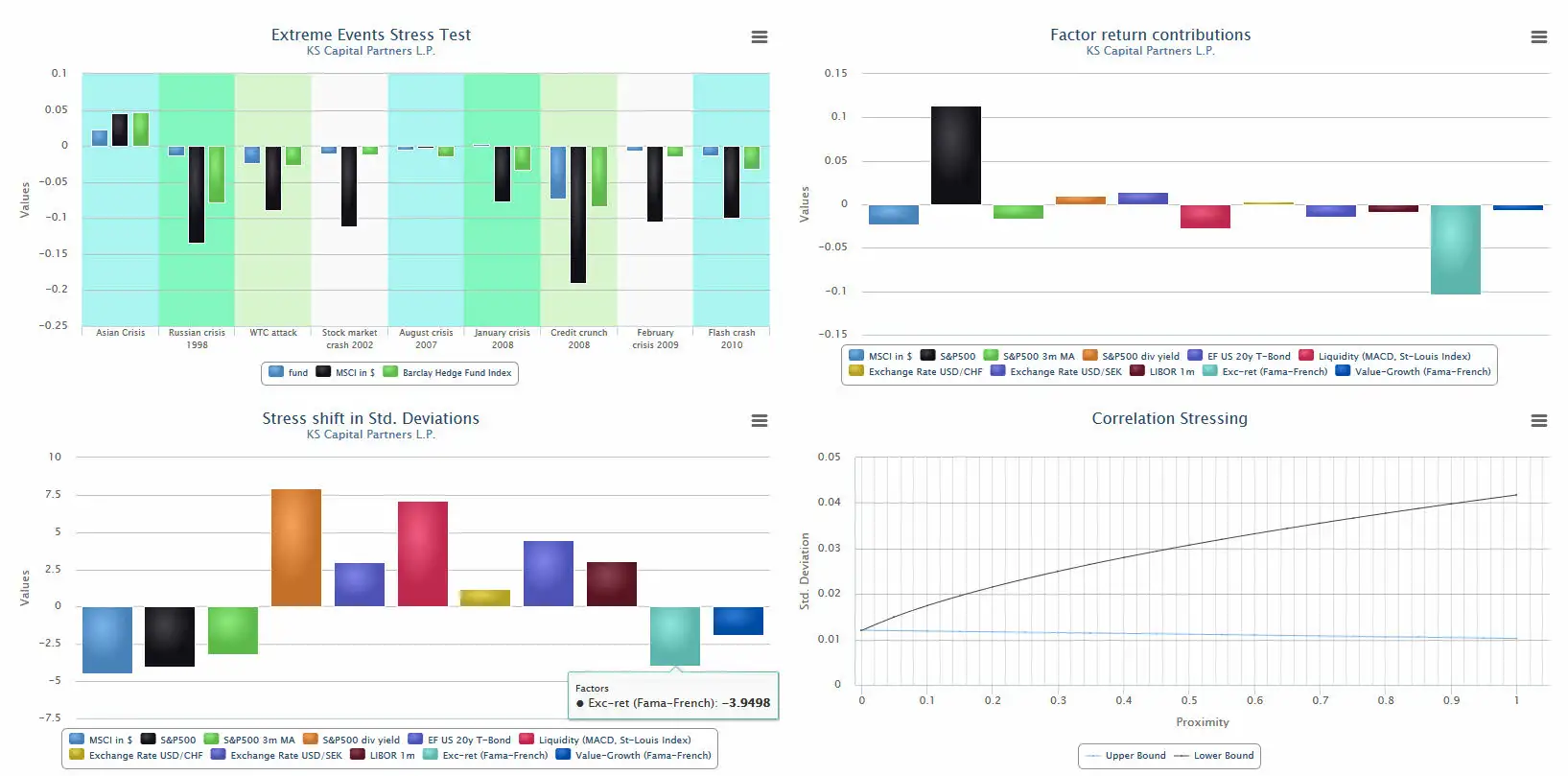

- Stress testing (macroeconomic events and correlation stressing)

- Risk budgeting (multiple budgeting strategies including Equal Risk Contribution, Most Diversified Portfolio, Global Minimum Variance and more)

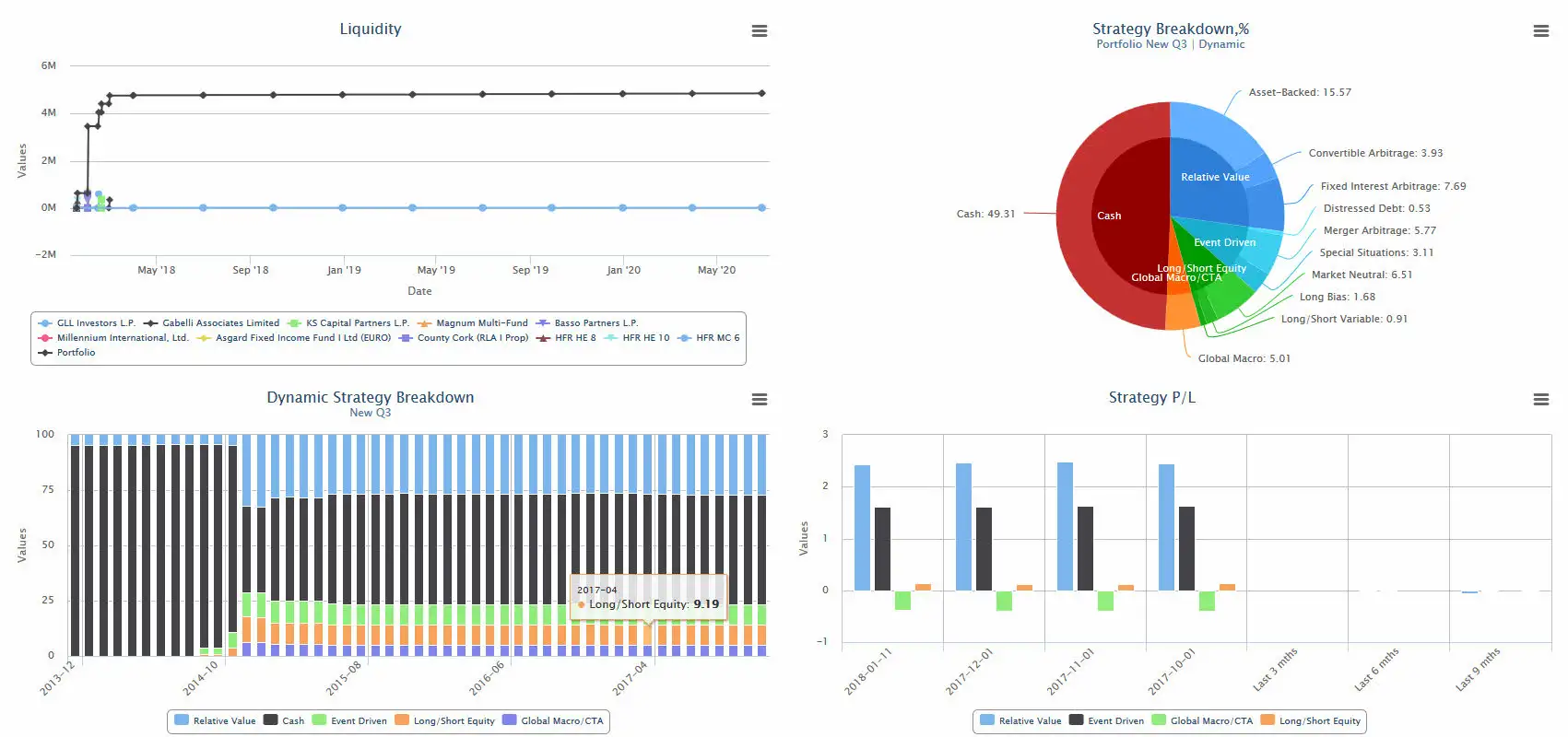

- Performance attribution analysis, style analysis, manager style drift and factor analysis

- What-if modeling for options and derivatives to assess the impact on your portfolios

- Private equity analysis tools

- Over 50 interactive charts including 3-D charts

- Investment reporting software

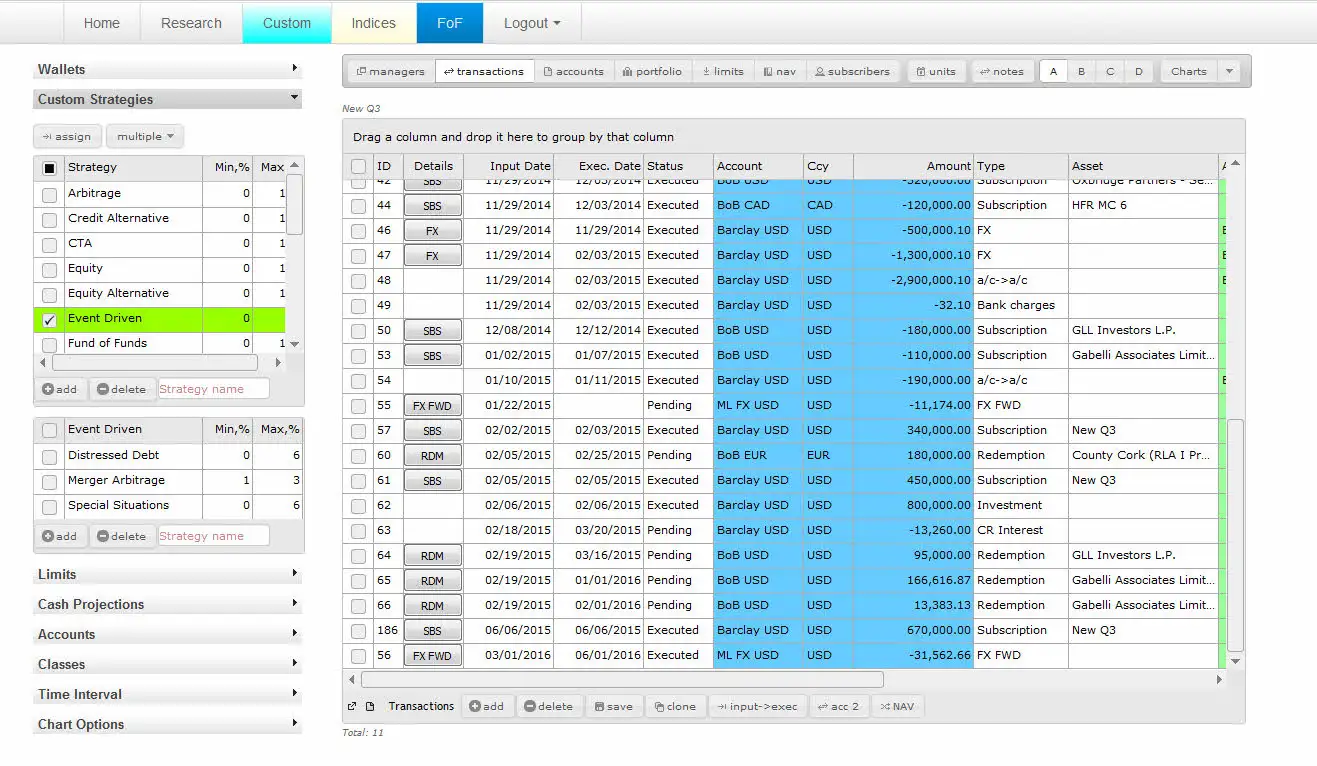

- Shadow accounting for Fund of Funds and multi-asset portfolios

- Portfolio management tools tailored for family offices

- CRM & Document management

- Due Diligence tools developed for hedge fund investors

Risk Shell Highlights

-

JOIN OUR WEBINAR

Risk Shell Introduction

23 Apr 2025;

09:00AM - 10:00AM

Risk Shell overview (Europe)06 May 2025;

10:00AM - 11:00AM

Fund Manager Portfolio Management Suite06 May 2025;

03:00PM - 04:00PM

Risk Shell overview (USA)07 May 2025;

09:00AM - 10:00AM

Risk Shell overview (Europe)

FAQs

Does Risk Shell support in-house databases?

Yes, custom data is fully supported. There are two ways of integrating custom data into Risk Shell. First, clients can easily create and maintain their own databases in the Risk Shell framework. Second, we can create a data bridge between our data servers and clients'. Then clients continue maintaining their in-house databases which will by synchronized with Risk Shell.Can I customize Risk Shell configuration?

Yes, you can select only modules and components you need. We offer several preconfigured Risk Shell packages (Basic, Ultimate I-III etc.) as well as flexible user-defined configurations. Furthermore, you can select required data feeds from the list of supported data vendors as well as use your own data.How often is Risk Shell being updated?

Usually, we provide 2-3 new Risk Shell releases per month - all based on new development requests of our clients. This way we can ensure a continuous enhancement of the platform as well as address the real needs of our clients.What happens with our workflow if the Risk Shell server is down?

So far, we have never had a single case of Risk Shell networks failures for the last 10 years. However, in the unlikely event of a network outage, clients can instantly switch to one of our redundant servers, fully synchronized with production servers.

Is Risk Shell less secure than desktop applications?

In fact, Risk Shell is more secure than common desktop applications, because it doesn't require an access to clients' PCs. Risk Shell is hosted on a private dedicated server network and protected by numerous security measures including multiple firewalls and IP validation. It has been thoroughly vetted and approved by top institutional investors imposing strict security requirements.Do you provide backups of clients' data?

Yes, there are two levels of custom backups: automatic system backups twice a day and user-initiated manual backups. We save system backups for a period of two years.Can you help us migrate our portfolios and data into Risk Shell?

Yes. Many of our clients come from different analytical platforms where they accumulated significant amounts of research data, portfolio allocations and custom assets (funds). Migrating that data to Risk Shell could be challenging and time consuming. That is why, we offer data migration services covering any data formats across any existing analytical platforms.Does Risk Shell support team environments?

Yes, it natively integrates special tools for sharing various objects (e.g. portfolios, custom assets, research settings etc.) across team members according to the user-defined access rules. These rules are to set up by system administrators based on clients' requested protocols.