Private Equity Portfolio Management Software

Private equity investments are becoming increasingly popular, attracting a wide range of investors, from big institutions to wealthy individuals and family offices. However, investing in private equities is not as straightforward as buying stocks or bonds. It requires special tools and techniques because private equities are different from regular investments. Conventional methods for assessing risks of equities or fixed income instruments are hardly applicable for private equities. To meet the needs of private equity investors, multi-asset managers, and family offices allocating in private equities, Risk Shell includes a dedicated component specifically designed for private equity risk management.

Private Equity Risk Management

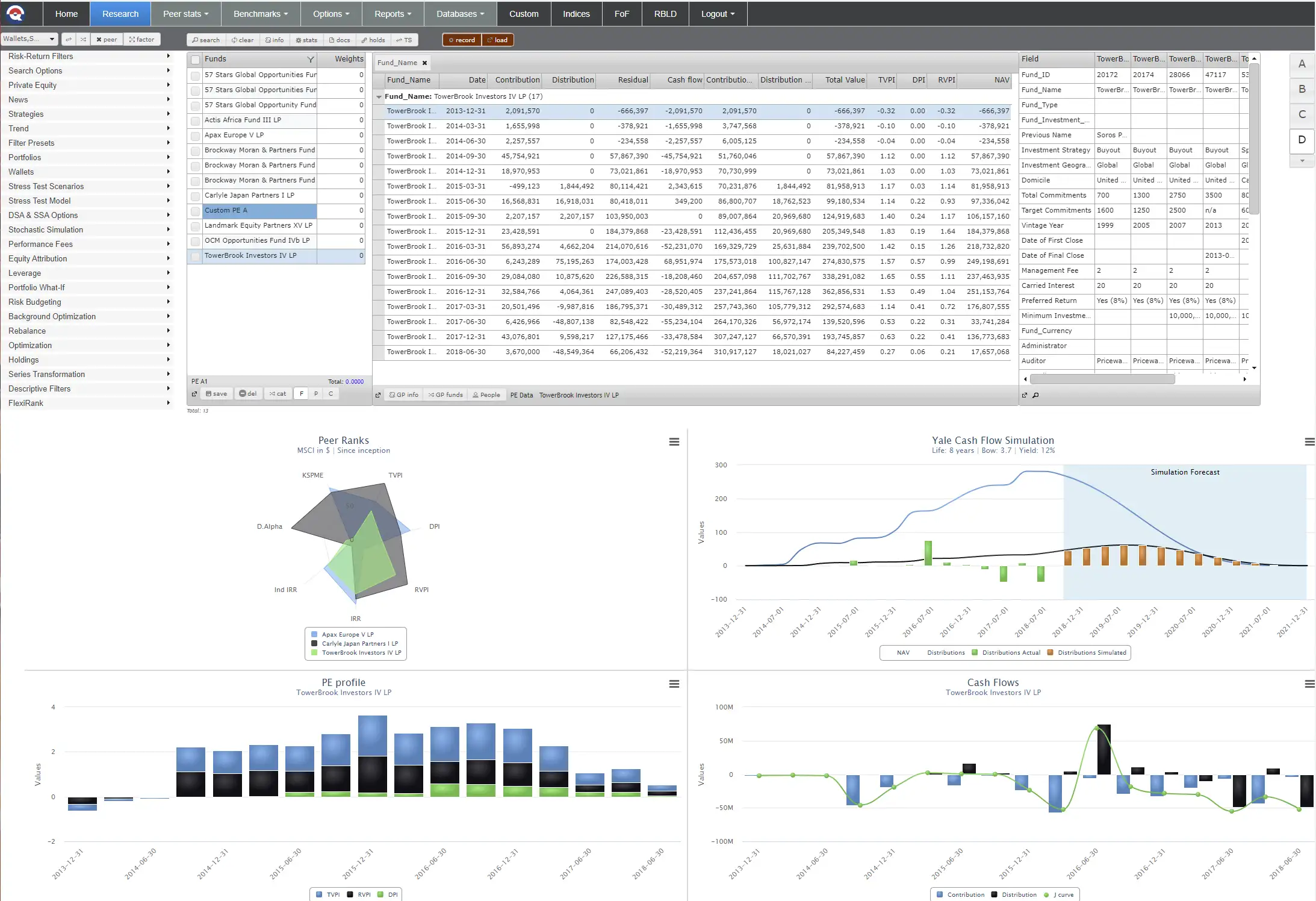

The private equity analysis within Risk Shell offers the following features:

- A broad range of private equity risk statistics including Direct Alpha, Index IRR, and KSPME

- The Yale Cashflow Forecasting model

- Automated mapping with external or in-house custom private equity databases

- Over 100 search filters covering funds, general and limited partners

- Various options for calculating PE risk statistics: Risk Shell database, real-time or vendors' data

- Integrated Multi-statistic Peer Group Analysis for private equities

- 3D interactive charting adopted to PE multi-faceted risk visualization

- Custom user-defined cash flow assets, like real estate investments

Private Equity Portfolio Management

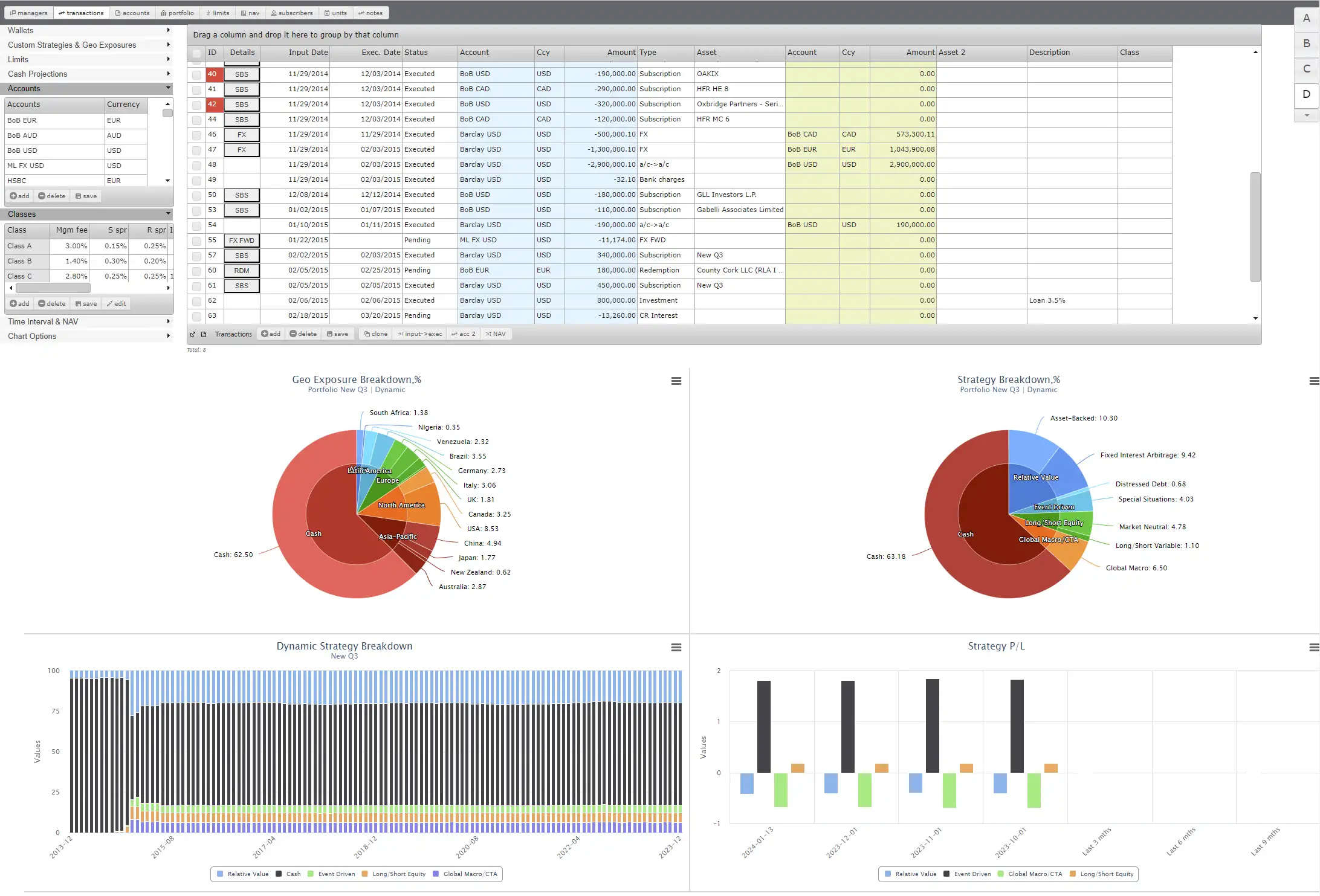

The Risk Shell FoF Manager seamlessly includes private equities as separate portfolios or combines them with other assets. For instance, you can make various portfolios of global equities, hedge funds (fund of funds), private equities, or real estate. Then, you can analyze each portfolio separately using its specific risk assessment models or combine them to see the overall risk of all your investments across different asset classes.

PE Software Highlights

-

JOIN OUR WEBINAR

Private Equity Risk Evaluation

27 Aug 2025;

04:00PM - 05:00PM

Private Equity Analysis24 Sep 2025;

04:00PM - 05:00PM

Private Equity Analysis

FAQs

Why cannot we use conventional risk models for PE?

Conventional risk models designed for traditional asset classes like stocks and bonds may not be suitable for private equity (PE) investments due to several reasons. These include the lack of market liquidity in PE investments, making it difficult to assess risk accurately using conventional models reliant on market prices and trading activity. Valuing private equity assets can be complex and subjective, further complicating risk assessment. Additionally, the longer investment horizon of PE investments, non-linear payoffs, and diversification challenges inherent in concentrated portfolios pose additional hurdles for conventional risk models.Why do you use PE risk models for real estate?

We can use private equity (PE) models for real estate investments because real estate is characterized by cash flows, similar to private equity. Real estate investments can be easily described using terms commonly used in private equity, such as capital calls for investments or reinvestments, and distributions or rental payments for returns. Both private equity and real estate involve long-term investments with a focus on cash flow generation, making them compatible in terms of modeling and analysis. This allows for the application of private equity risk assessment models to real estate investments, leveraging the similarities in cash flow dynamics between the two asset classes.Why isn't private equity (PE) risk modeling commonly taught in mainstream finance educational programs?

Private equity (PE) risk modeling is not commonly included in traditional finance educational programs for several reasons. Firstly, private equity investments are typically limited to accredited investors or institutional investors due to regulatory requirements and minimum investment thresholds. As a result, the broader population of retail investors may not have direct exposure to private equity, reducing the demand for education in this area. Additionally, the complexities of private equity investing, including illiquidity, long investment horizons, and specialized valuation methods, make it a more niche area of study compared to publicly traded securities. Moreover, the proprietary nature of many private equity firms and the confidential nature of their investment strategies may limit the availability of data for educational purposes.Do you offer training and educational programs specifically focused on private equity (PE) risk management?

Yes, we provide customized training programs at no cost for all new Risk Shell clients. These programs are tailored to the specific needs of each user and can cover a wide range of topics, including private equity (PE) risk management, upon request. Our goal is to ensure that our clients are equipped with the knowledge and skills necessary to effectively utilize Risk Shell for their investment management needs.

What is the Index IRR statistic for PE and how dies it compare to traditional IRR?

The Index IRR statistic for private equity (PE) is a performance measure that calculates the internal rate of return based on index values rather than individual cash flows. It compares the performance of a PE investment to a relevant market index, providing a benchmark for evaluating relative performance. Compared to traditional IRR, which relies on specific cash flow data, Index IRR offers a broader perspective by considering overall market movements, making it useful for assessing the performance of PE investments in relation to broader market trends.What is the KSPME statistic for private equities, and how does it compare to traditional IRR?

The KSPME statistic, which stands for Kernel-Smoothed Probability Mass Estimator, is a risk-adjusted performance measure used specifically for private equity investments. Unlike traditional metrics such as Internal Rate of Return (IRR), which rely on assumptions about cash flow timing and magnitude, KSPME takes into account the uncertainty and variability of cash flows inherent in private equity investments. By using a non-parametric approach based on kernel smoothing techniques, KSPME provides a more robust and accurate estimate of the probability distribution of future cash flows, allowing investors to better assess the risk-adjusted performance of their private equity investments. One of the key advantages of KSPME over traditional IRR is its ability to capture the full range of potential outcomes and provide a more comprehensive measure of risk-adjusted return, particularly in situations where cash flows are uncertain or irregular. Additionally, KSPME does not require specific assumptions about reinvestment rates or cash flow timing, making it more flexible and applicable to a wider range of private equity investment strategies. Overall, KSPME offers investors a more reliable and informative tool for evaluating the performance and risk of their private equity portfolios.What does the Direct Alpha statistic measure in private equity (PE) investments?

The Direct Alpha statistic for private equity (PE) is a performance measure that evaluates the excess returns generated by a private equity investment relative to a chosen benchmark or risk-free rate. Unlike traditional measures like the Sharpe ratio or IRR, which focus on risk-adjusted returns, Direct Alpha specifically quantifies the value added by the private equity investment manager through active management decisions and deal selection. Direct Alpha is calculated as the difference between the actual returns of the private equity investment and the returns that would have been achieved by investing in a passive alternative, adjusted for any additional risk taken. This statistic provides investors with insight into the skill and effectiveness of the private equity manager in generating alpha, or outperformance, relative to the market or a specified benchmark.We subscribe to several PE databases and also maintain our own in-house PE datasets. Can you help us aggregate all the data in Risk Shell?

Yes, we offer a custom data integration program that allows us to link your subscribed private equity (PE) databases as well as your in-house PE datasets to Risk Shell. Through this program, we can aggregate and consolidate all the data into a single dataset within Risk Shell. This streamlined approach enables you to access and analyze all your PE data in one centralized platform, facilitating more efficient decision-making and portfolio management.