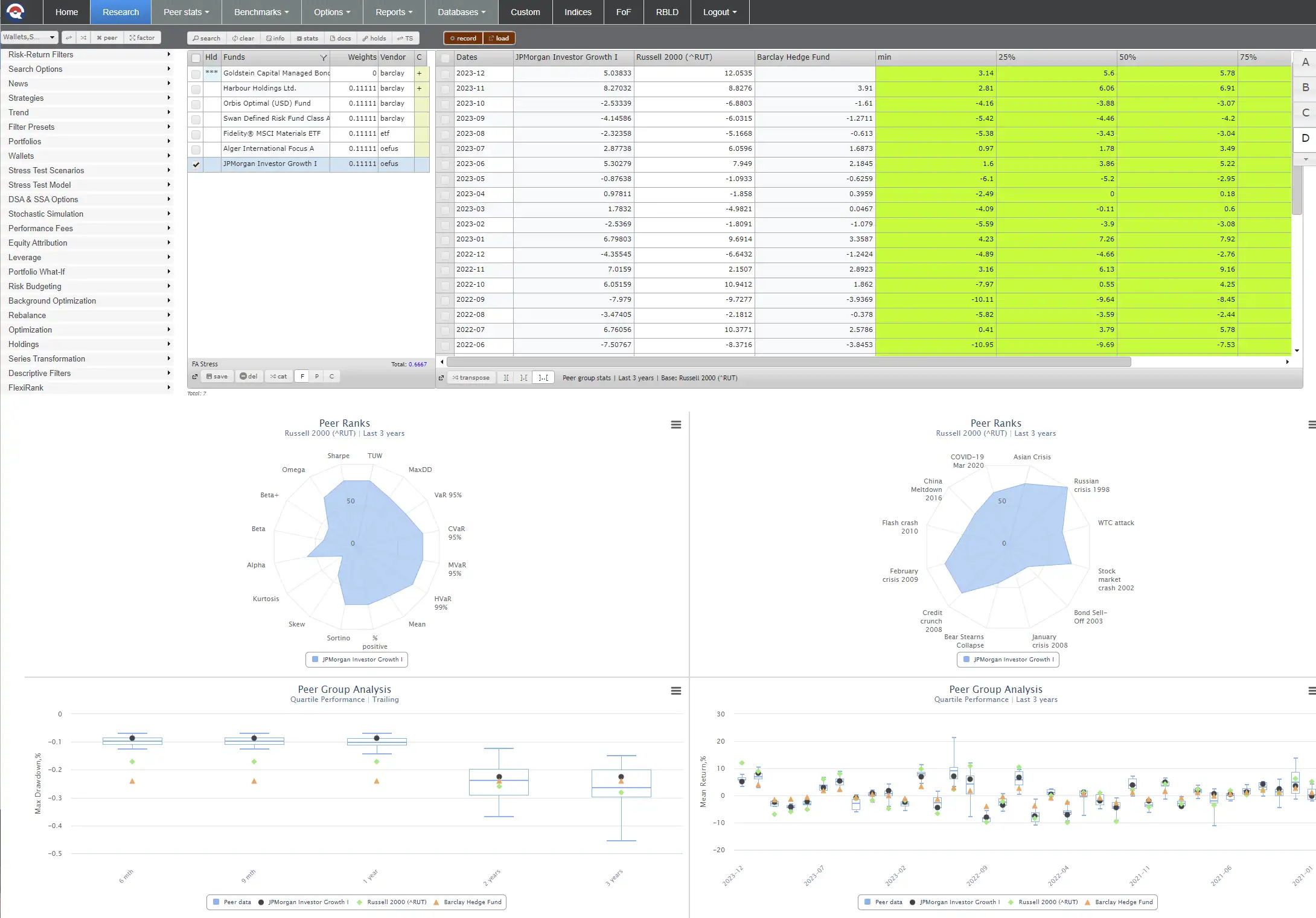

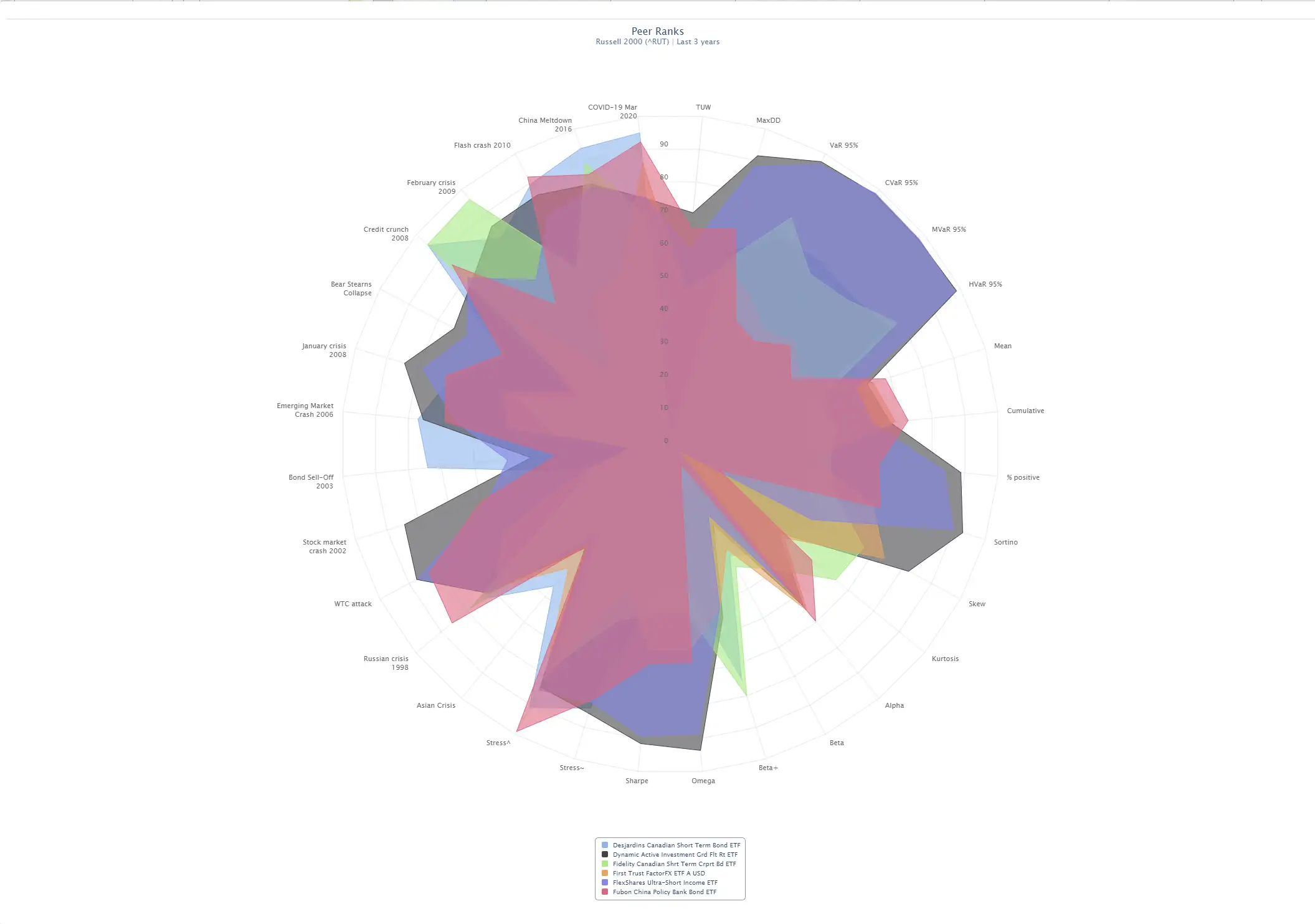

Peer Group Stress Testing

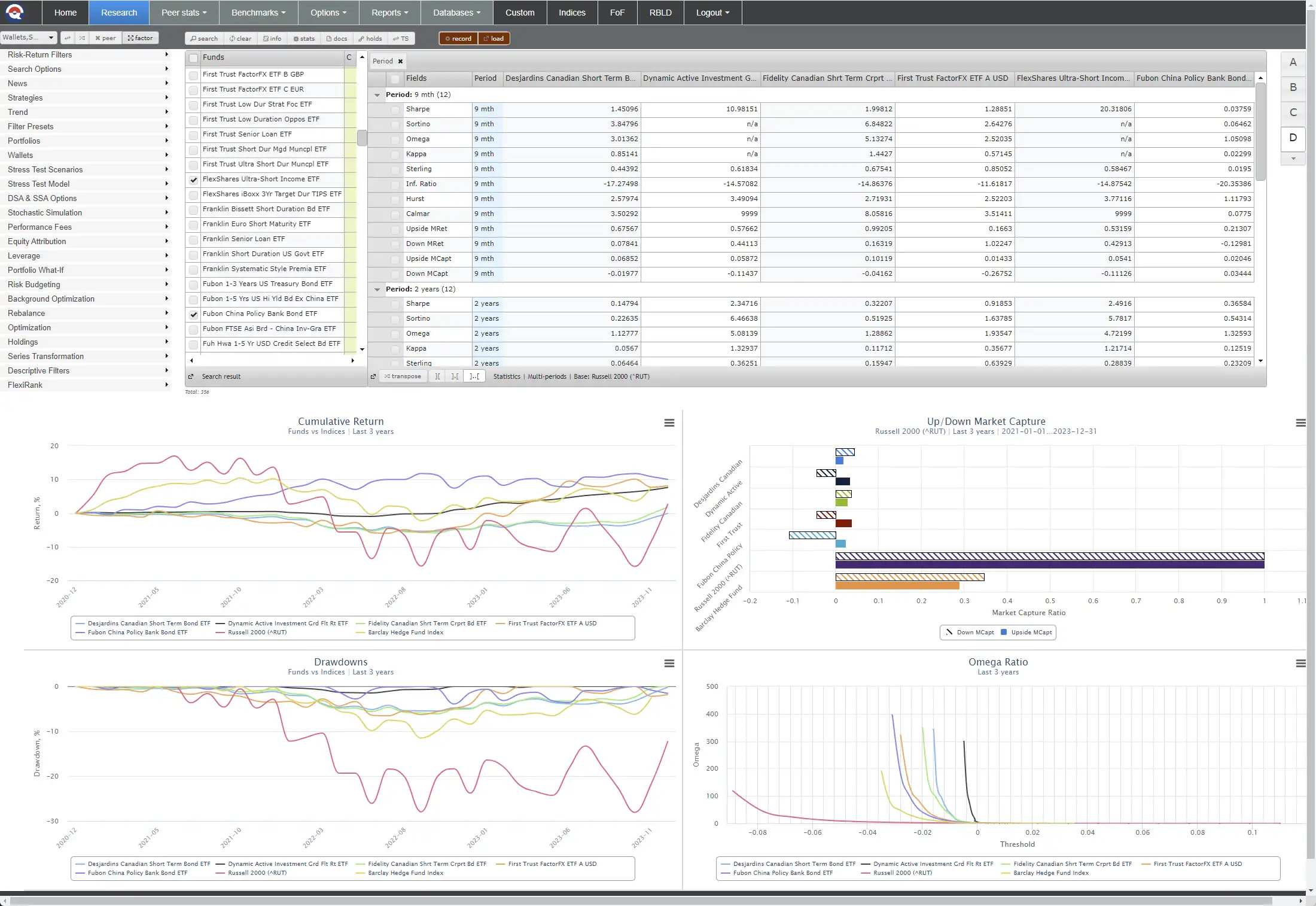

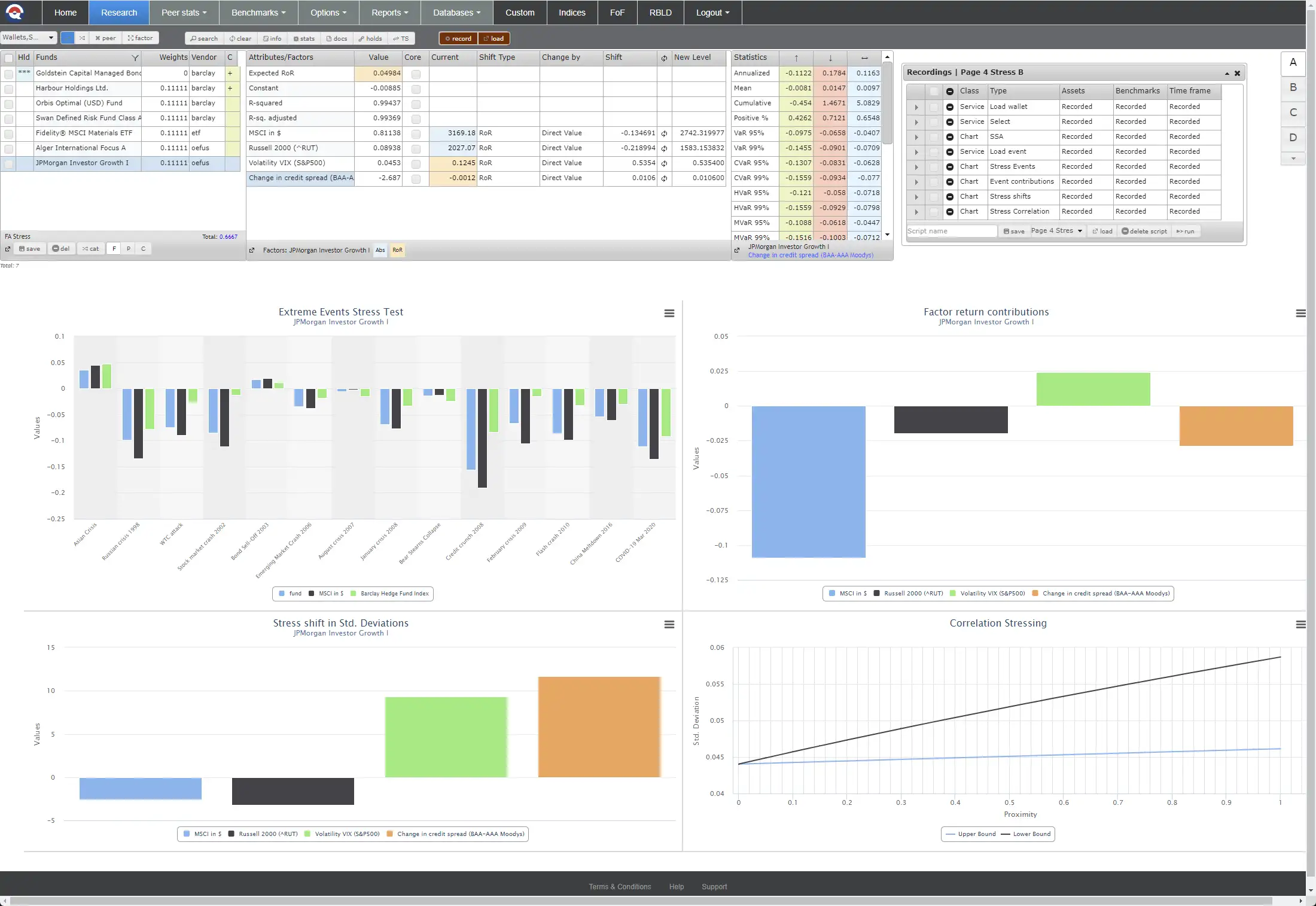

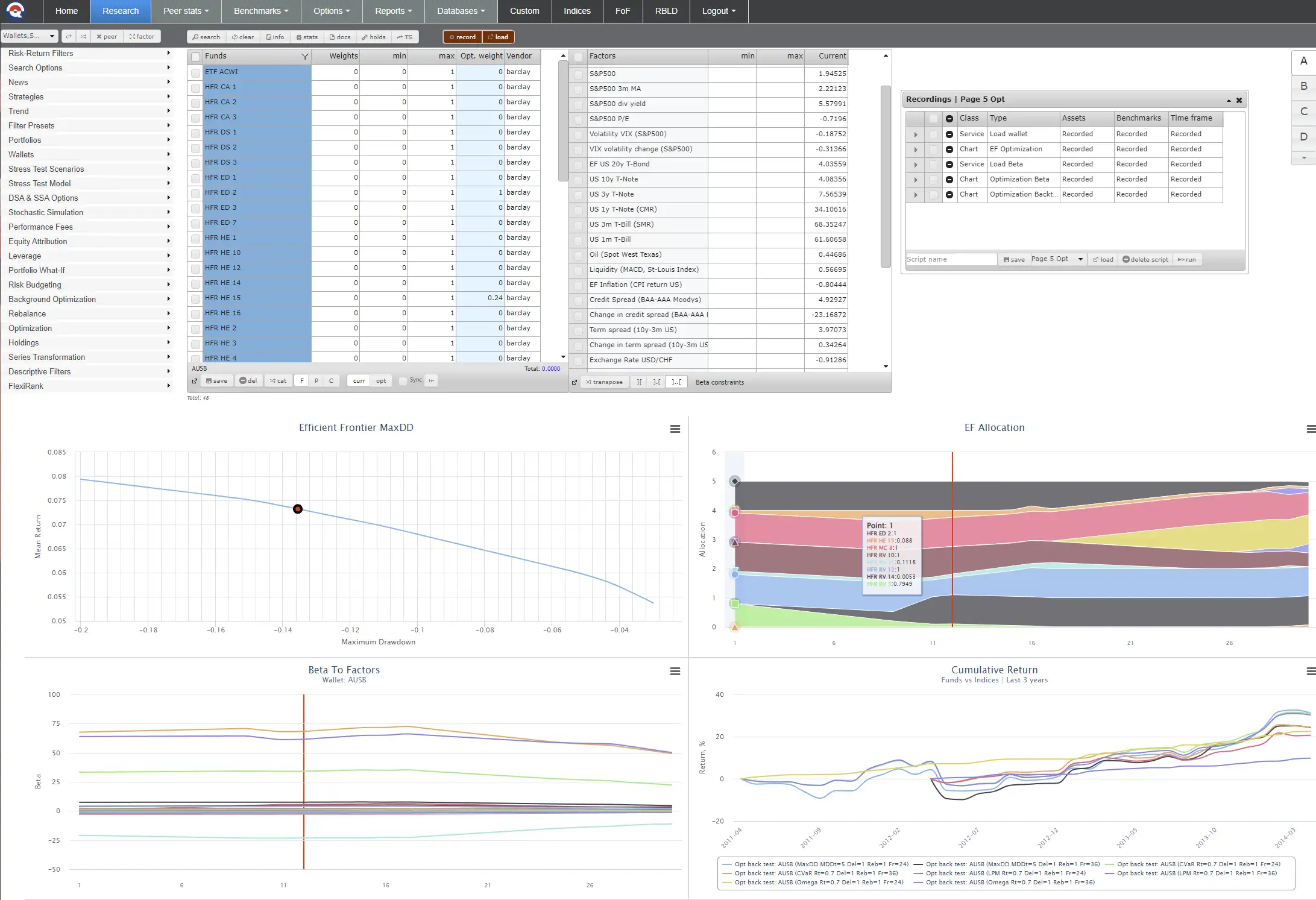

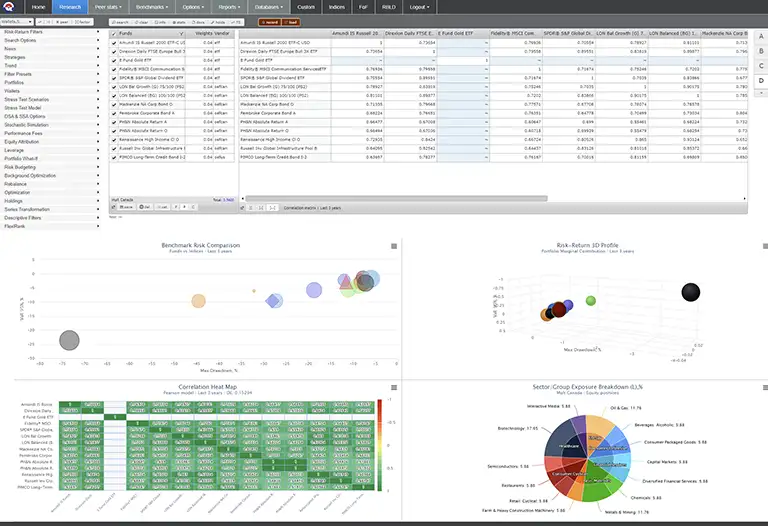

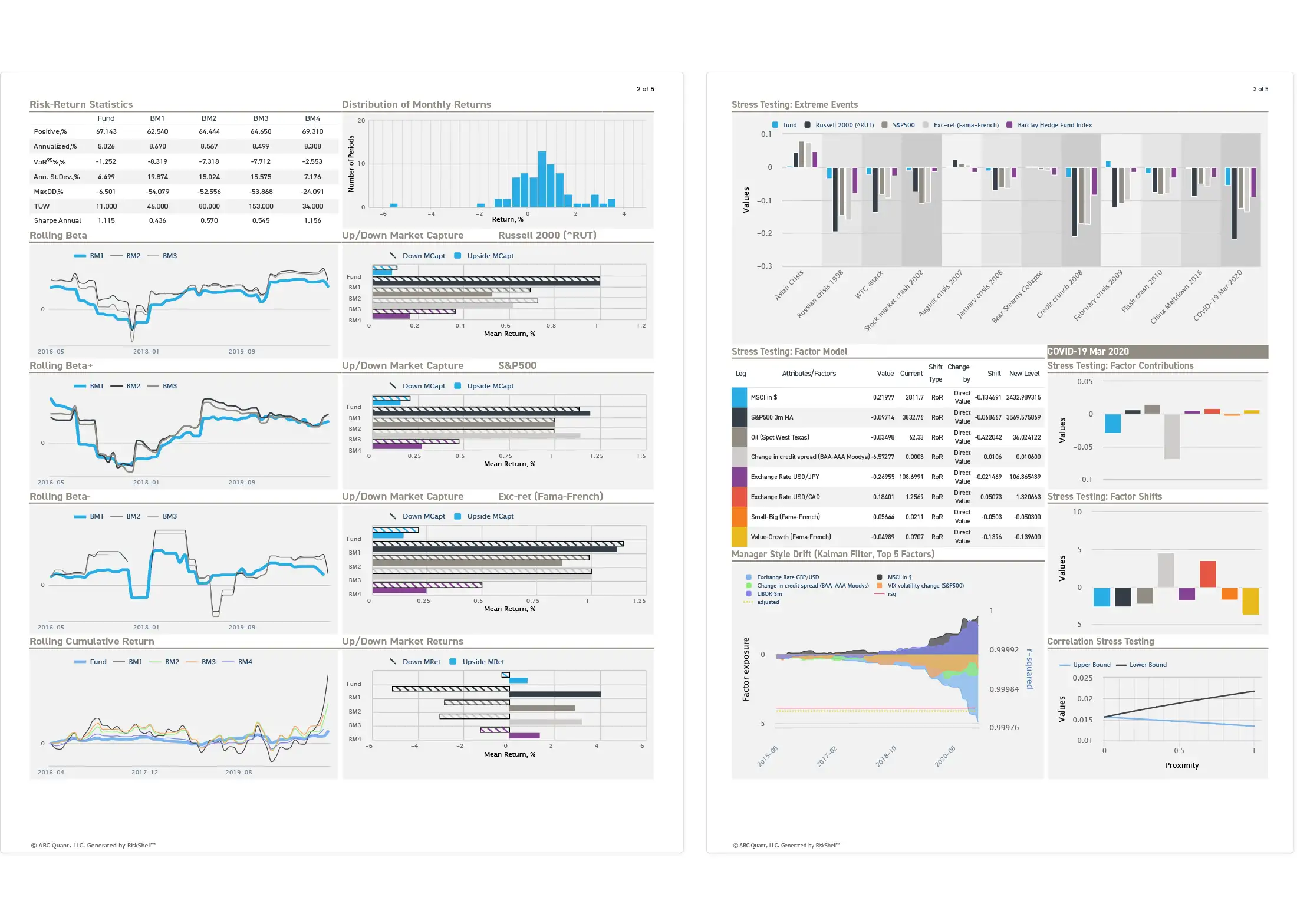

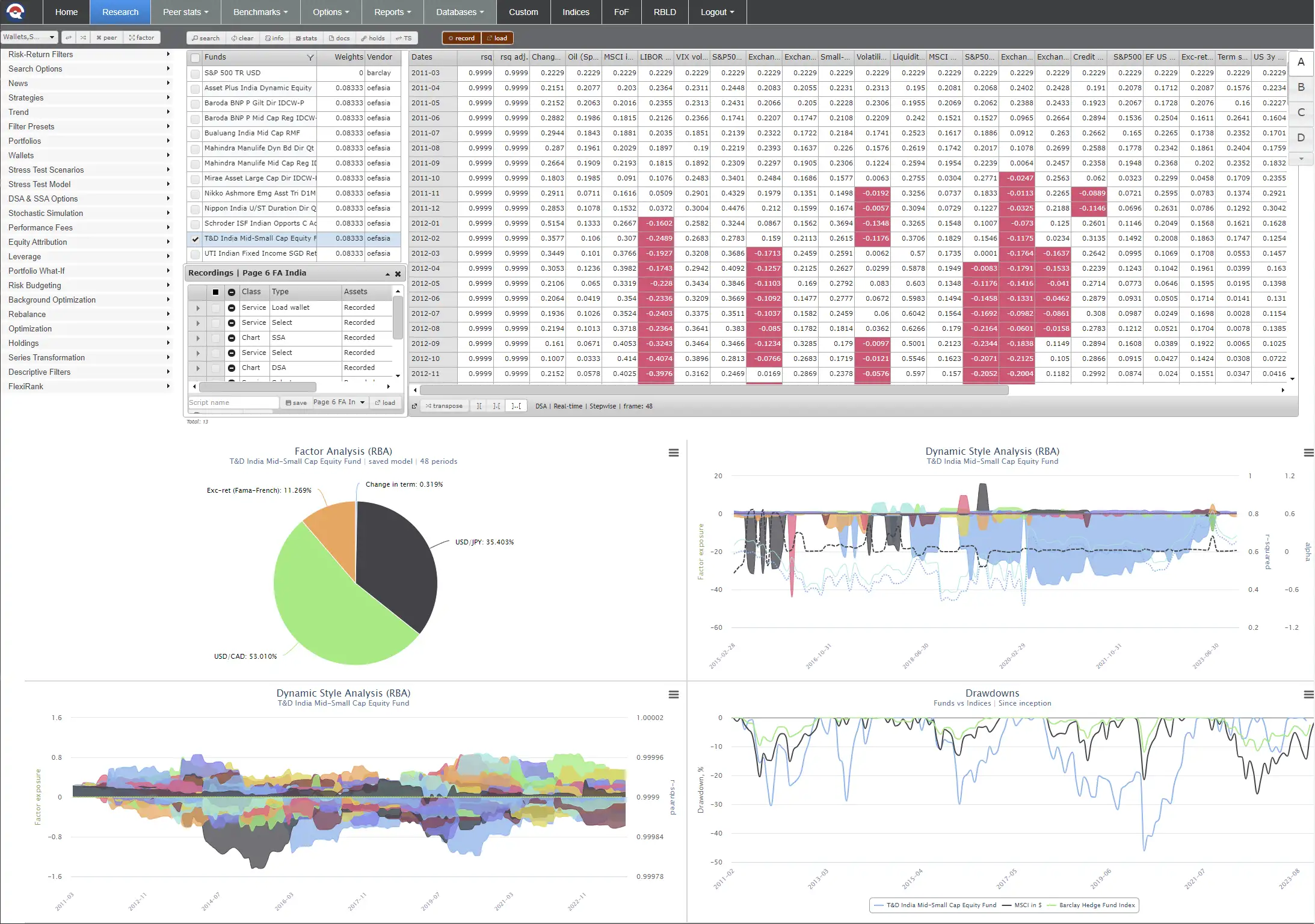

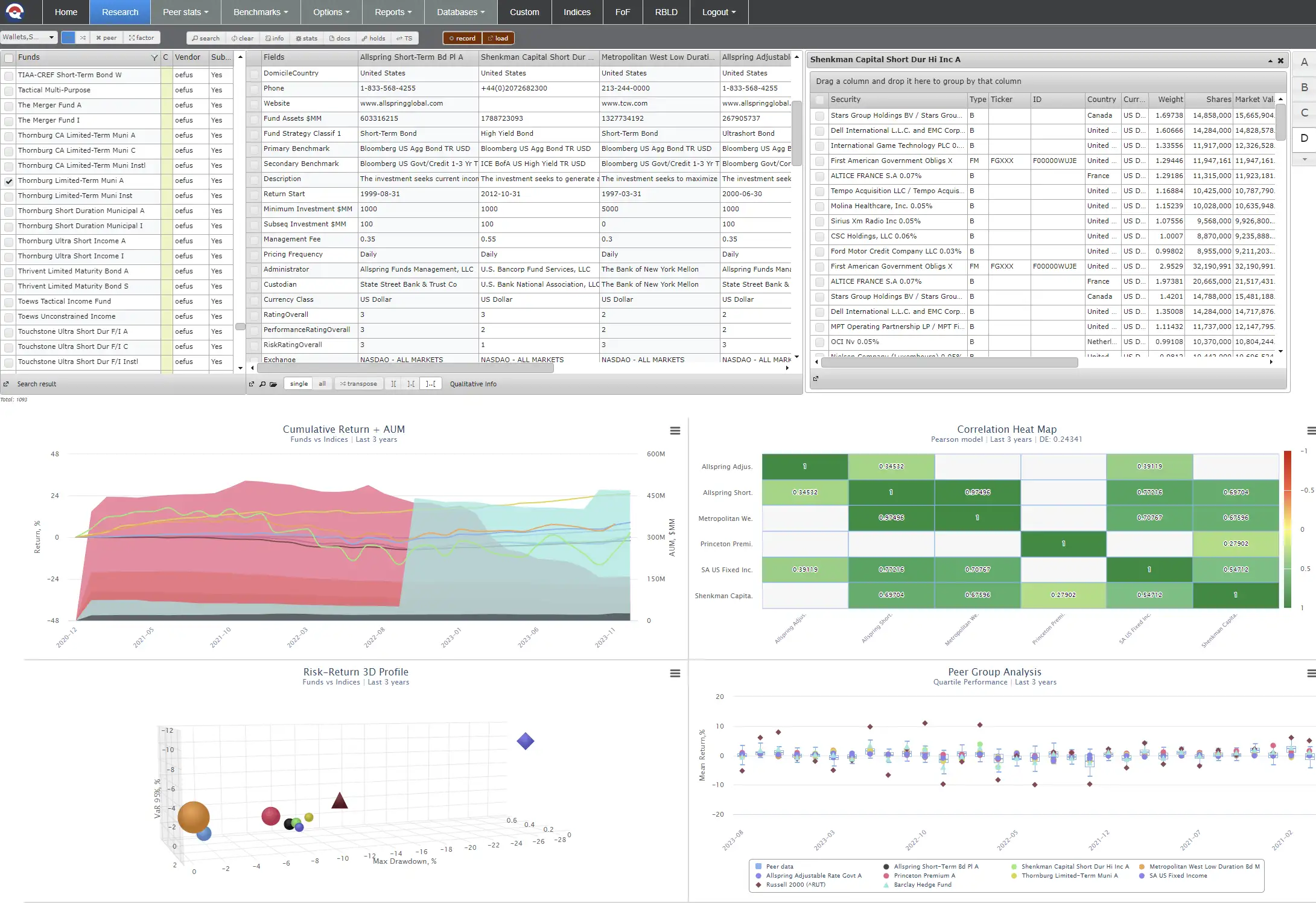

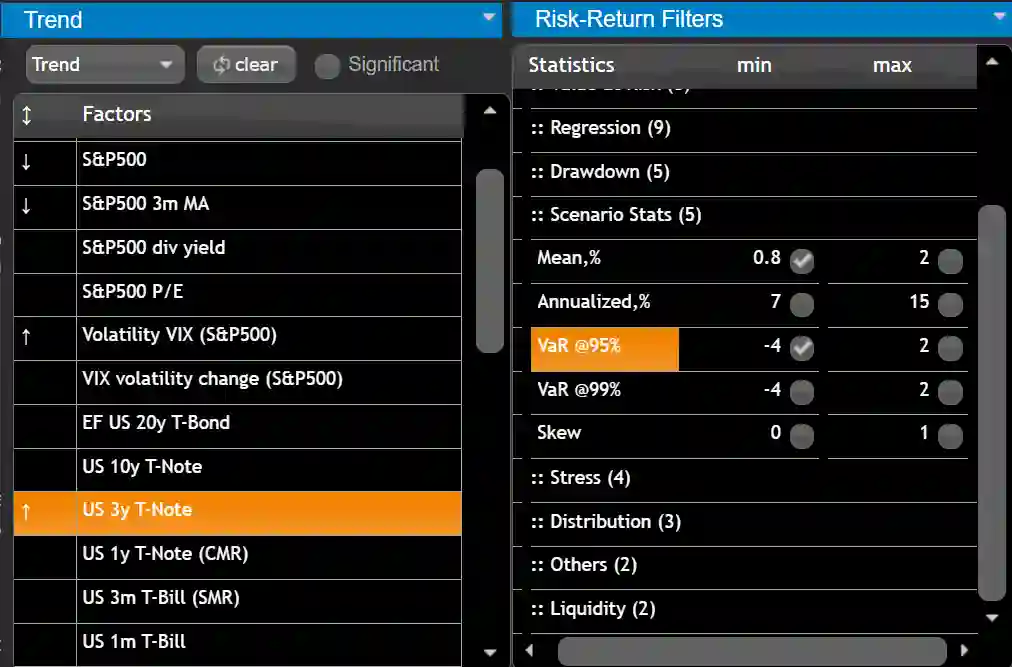

- Analyze stress results for assets across historical extreme events in comparison to a peer group

- Supported by the continuously updated Global Stress Test database

- Identify top-tier performers with resilient stress results during the screening phase

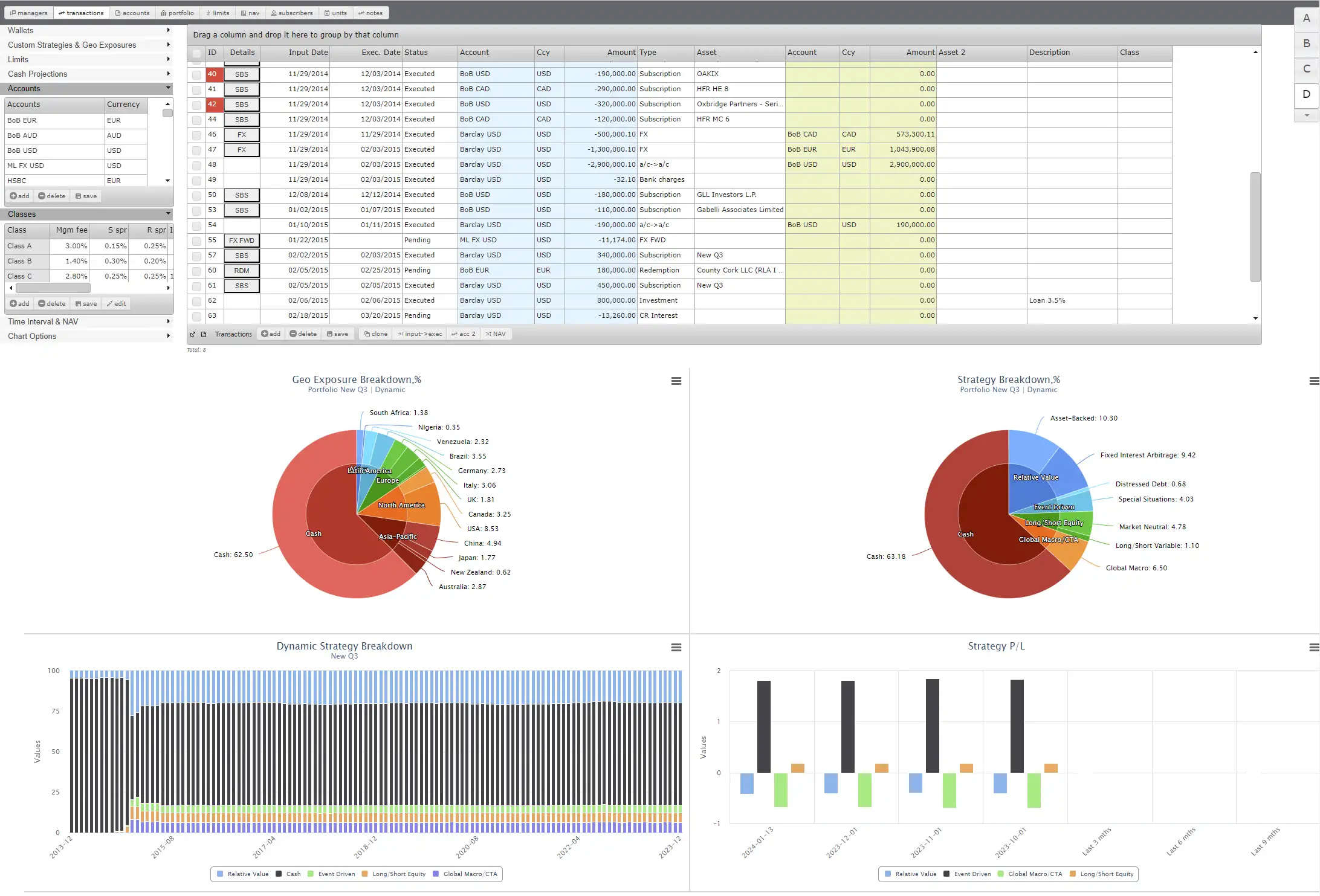

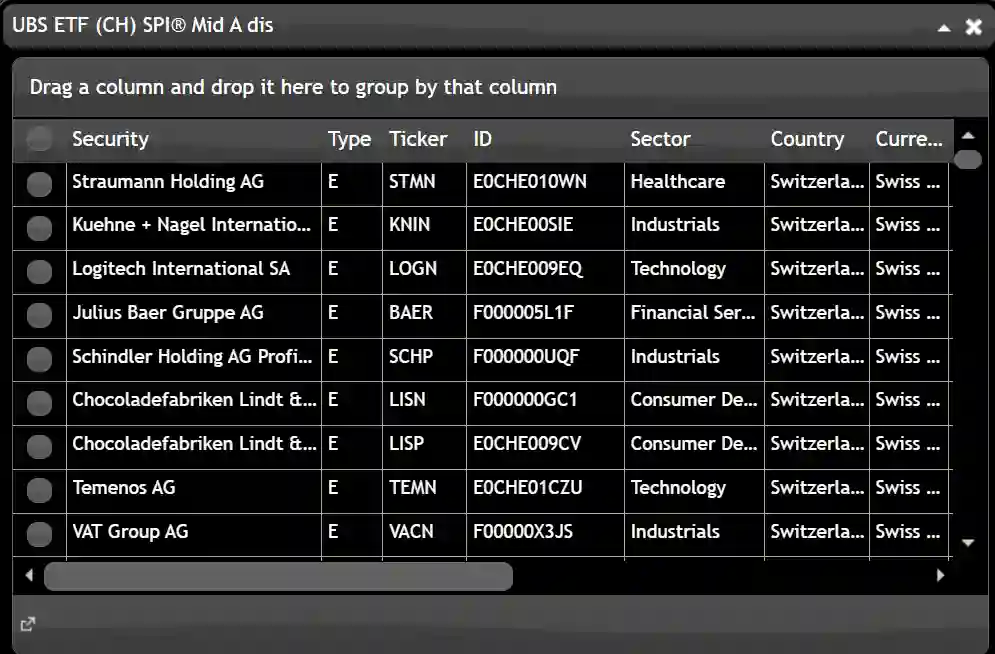

- Combine different asset classes to enhance stress test results for the portfolio